THE SITUATION

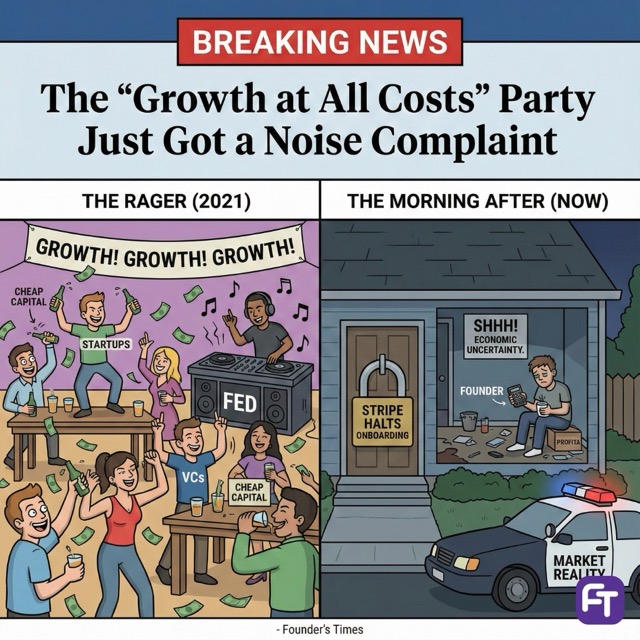

Stripe has indefinitely paused new customer onboarding effective immediately, citing “economic uncertainty.” The halt impacts all self-serve signups globally, while enterprise sales remain open.

The timing aligns with a broader risk-off pivot. With ~$1.4 trillion in processing volume and a valuation stabilizing around $70B (down from $95B peak), Stripe is shifting from growth-at-all-costs to margin protection.

The immediate casualty is the early-stage ecosystem. Thousands of startups launching in Q4 2025 now lack their default payment rail. This forces a mass migration to “Merchant of Record” (MoR) alternatives that handle the liability Stripe no longer wants.

WHY IT MATTERS

- For early-stage founders: Launch velocity drops immediately. Approval times shift from “5 minutes” to “5-10 days” as alternative providers struggle to absorb volume.

- For Merchant of Record (MoR) platforms: Customer acquisition costs (CAC) drop near-zero overnight. Providers like Paddle and Lemon Squeezy become the default infrastructure for SaaS.

- For Stripe: This signals a permanent exit from the “long tail” market. The company is re-rating itself as enterprise infrastructure (competing with Adyen) rather than a startup utility.

BY THE NUMBERS

- Stripe TPV: $1.4T+ in 2024, up ~40% YoY (Source: Stripe Annual Letter, 2024)

- Valuation: ~$70B in 2024 secondary sales, down from $95B peak in 2021 (Source: TechCrunch, July 2024)

- Gross Revenue: Est. $18B for 2024 (Source: Backlinko/GetLatka Analysis, 2025)

- Fraud Losses: Global payment fraud projected to hit $40B+ by 2027 (Source: Nielsen Report)

- Competitor Stock: Adyen (ADYEN.AS) up 12% in pre-market trading following the news

Stripe is no longer a startup; it is a financial institution minimizing balance sheet risk before an eventual public listing.

COMPETITOR LANDSCAPE

Merchant of Record (MoR) players win the low end. Paddle and Lemon Squeezy will absorb the displaced SMB volume. Their model (acting as the reseller rather than just a processor) handles the global tax/compliance burden Stripe is shedding. Expect their valuations to double in upcoming rounds.

Adyen and Braintree solidify the high end. Adyen has always refused the “self-serve” market, focusing purely on enterprise volume. Stripe’s move validates Adyen’s long-standing thesis: the long tail is unprofitable. Braintree (PayPal) remains the only viable fallback for high-volume startups, but their legacy tech stack remains a friction point.

INDUSTRY ANALYSIS

The era of “permissionless innovation” in fintech is closing. For a decade, VCs subsidized the risk of instant onboarding. Now, with capital costs >5%, infrastructure providers are dumping high-risk cohorts (SMBs) to protect margins.

The sentiment shift is visible. Investors who previously preached “growth” are now demanding “unit economics.” On LinkedIn, fintech operators are already calling this the “Compliance Cliff”—the moment where regulatory cost outweighs the benefit of serving the bottom 50% of the market.

Capital will flow into “Compliance-as-a-Service.” Investors will flee pure payment processors (low margin, high risk) and pile into platforms that bundle payments with tax, identity, and fraud liability (high moat, high retention).

FOR FOUNDERS

- If you are pre-revenue: Apply to 3+ payment providers immediately. Do not rely on a single rail.

- If you are building a B2B platform: Stop building your own payments stack. The compliance burden just became existential. Integrate a white-label MoR solution before Q1 2026.

- If you currently use Stripe: Audit your risk profile. If you are in a “grey” vertical (AI, crypto, adult, gaming), you are next on the chopping block. secure a backup provider within 30 days.

FOR INVESTORS

- For fintech portfolios: Short pure-play payment processors (who now face Stripe’s rejected risk). Long infrastructure players that handle tax/compliance (MoR).

- For SaaS investments: Expect a “launch drag.” Portfolio companies will launch slower due to compliance friction. Adjust Q1/Q2 revenue targets down by 15%.

- Signal to watch: Look for “Merchant of Record” startups raising Series A/B. The TAM for these companies just expanded by the entire bottom half of the internet economy.

THE COUNTERARGUMENT

The counterargument: This is a temporary technical pause, not a strategic exit. Stripe could be retooling its fraud engines to handle AI-driven synthetic identity attacks. Once the new “Radar” models are deployed (3-6 months), onboarding reopens.

This would be true if Stripe were still valuing growth over profitability. But the data—layoffs, enterprise focus, and delayed IPO—suggests otherwise. They are dressing the bride for a public debut, and “unlimited SMB risk” is not a selling point for Wall Street.

BOTTOM LINE

Stripe just abdicated the startup market to pursue the Fortune 500. The “default global access” for commerce is gone. Startups must now pay a “compliance premium” to MoR providers or face banking rejection. The friction to start a company just went up 10x.