THE SITUATION

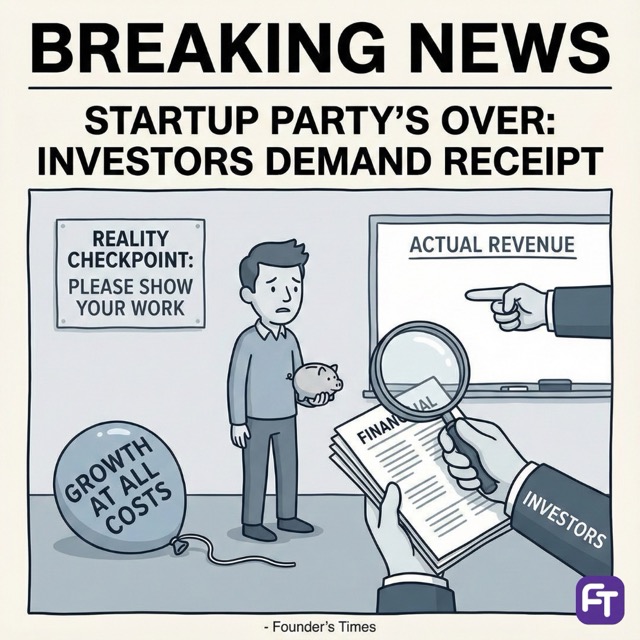

Indian startups are exiting the “growth at all costs” era and entering a phase of forensic financial scrutiny. Data from Inc42’s FY25 tracker reveals a stark bifurcation: while funding volume recovered in Q3 2024, capital is selectively targeting profitability over pure GMV growth.

The numbers tell the story. While Q3 2024 funding doubled YoY to $3.4B, valuations are correcting. Swiggy slashed its IPO valuation target by ~25% to $11.3B, and Prosus wrote off its entire 9.6% stake in Byju’s, effectively valuing the former decacorn at zero.

This shifts the market dynamic immediately. The “growth premium” is dead. Investors now demand audited governance and clear paths to EBITDA positivity before Series B, not just at IPO.

WHY IT MATTERS

- For late-stage founders: Valuation multiples compress 30-40% for companies without 12 months of clean EBITDA data.

- For early-stage investors: Due diligence timelines extend by 4-6 weeks as governance checks become the primary deal-breaker.

- For the “soonicorn” class: The IPO window is open only for the disciplined—markets punish high-burn models (like Kiwi spending ₹19 to earn ₹1) regardless of growth rates.

BY THE NUMBERS

- Q3 2024 Funding: $3.4B raised, up 100% YoY from $1.7B in Q3 2023 (Source: Inc42, Oct 2024)

- Byju’s Valuation Implication: Prosus wrote down $493M investment to zero; implied valuation crash from $22B peak (Source: Prosus FY24 Report)

- Swiggy IPO Adjustment: Valuation target cut from $15B initial guidance to $11.3B (Source: Reuters/Mint, Oct 2024)

- High Burn Example: Fintech startup Kiwi reported spending ₹19 to earn ₹1 in FY25 (Source: Inc42, Nov 2024)

- Mega Deal Resurgence: 10 deals over $100M in Q3 2024, up from 3 in Q3 2023 (Source: Inc42, Oct 2024)

- Profitability Shift: Zomato profit jumped to ₹253 Cr in Q1 FY25; Apna narrowed losses to ₹50 Cr (Source: Inc42, Oct 2024)

CONTEXT

The ecosystem is witnessing a tale of two trajectories: the correction of the old guard and the discipline of the new aspirants.

Byju’s represents the collapse of the 2021 paradigm. Once India’s most valuable startup at $22B, it faced a complete unraveling in 2024. Prosus, a key backer, wrote off its 9.6% stake, citing “inadequate information on financial health.” This governance failure has permanently raised the bar for reporting standards across the sector.

Conversely, Swiggy represents the new pragmatic reality. Despite being a market leader, it adjusted its IPO valuation expectations downward to $11.3B to align with public market sentiment. This demonstrates a maturity that prioritizes successful listing and retail trust over vanity valuation metrics. The market is rewarding transparency: Zomato’s pivot to profitability (₹253 Cr profit in Q1 FY25) has set the benchmark Swiggy must now match.

COMPETITOR LANDSCAPE

The market has split into “Audited Growth” vs. “Vanity Growth” camps.

In the “Audited Growth” tier, public market leaders like Zomato and PB Fintech are setting the pace. Zomato’s stock performance (up significantly YoY) validates the model of sacrificing growth speed for margins. Quick commerce disruptors like Zepto ($665M raise in 2024) are being forced to prove unit economics earlier to justify valuations that rival their listed peers.

In the “Vanity Growth” tier, high-burn models are facing existential questions. Fintech players relying on aggressive CAC (like Kiwi) are seeing scrutiny intensify. The days of raising Series C on “users added” are over; the metric is now “revenue per user vs. cost of service.”

Strategic divergence is widening. Late-stage startups are delaying IPOs to clean up books (e.g., Oyo’s refinancing), while bootstrapped or operationally efficient firms (like Zoho and Zerodha) continue to command premium authority without diluting equity, forcing VC-backed competitors to justify their burn rates.

INDUSTRY ANALYSIS

The Indian startup ecosystem is shifting from “Fear of Missing Out” (FOMO) to “Fear of Governance” (FOG).

Current state: Capital is available but selective. The $3.4B raised in Q3 2024 indicates the “funding winter” is technically thawing, but the warmth is unevenly distributed. Mega-rounds (Zepto, Meesho, PhysicsWallah) account for the bulk of this volume, leaving Series A/B companies in a squeeze if their unit economics aren’t pristine.

The shift: Governance is no longer a box-check; it is a valuation multiplier. SEBI and RBI actions in 2024 against lax compliance in fintech have spooked generalist investors. The premium has shifted from “total addressable market” to “regulatory durability.”

Public sentiment: Leading VCs are vocal about this reset. The focus has moved from “blitzscaling” to “durable compounding.” LinkedIn discussions among founders have pivoted from valuation bragging to “path to PAT” (Profit After Tax).

Capital flows: Money is moving away from unregulated “growth hacks” (e.g., BNPL models without NBFC licenses) toward infrastructure, deep tech, and consumer brands with proven gross margins. The 66% YoY jump in fintech funding in Q3 2024 is misleading if not viewed through this lens—it flowed almost exclusively to players with clean regulatory slates.

FOR FOUNDERS

- If you’re raising Series B+: Audit your FY25 financials now. Investors will treat any delay in data room population as a governance red flag.

- If you’re burning >$1M/month: Cut burn by 30% immediately unless you have 18 months of runway. The Q3 funding bump was for winners, not survivors.

- If you’re in fintech: Appoint a seasoned CFO/Compliance Officer before your next pitch. Regulatory clearance is now your primary product feature.

- If you’re planning an IPO in 2025: Lower your valuation expectations by 20% today. A successful flat round is better than a pulled IPO (learn from Swiggy’s pragmatism, avoid Byju’s hubris).

- If you have “adjusted EBITDA” metrics: Stop using them. Show the real cash flow. Investors are marking down “adjusted” metrics by 50%.

FOR INVESTORS

- For growth-stage portfolios: Initiate forensic governance audits on your top 3 positions. The Byju’s write-off proves that board seats do not guarantee visibility.

- For new deal flow: Prioritize “boring” metrics. Revenue consistency and statutory compliance are the new alpha. Pass on any founder who hedges on unit economics.

- For late-stage positions: Mark down holdings to public market equivalents (Zomato/Swiggy multiples). Holding assets at 2021 valuations prevents realistic exit discussions.

- Watch for: The “compliance hiring” signal. Companies aggressively hiring senior legal/finance talent are prepping for the new funding reality; back them.

THE COUNTERARGUMENT

The counterargument: The “funding winter” narrative is overstated, and scrutiny is cyclical, not structural.

Evidence for this view: Q3 2024 funding actually doubled YoY to $3.4B. High-profile deals like Zepto ($665M) and PhysicsWallah ($210M) suggest that for high-quality assets, 2021-style multiples are still achievable. India’s macro story (fastest-growing major economy) provides a floor that will eventually force capital back into the market regardless of governance concerns, simply due to lack of alternatives in China or Europe.

This interpretation would be correct if: (1) The RBI/SEBI relax scrutiny in 2025 to boost growth, or (2) Global interest rates drop fast enough to flood emerging markets with risk-on capital again.

However, the Byju’s collapse is a structural scar. It has fundamentally changed LP risk tolerance in India. Capital is back, but the terms of that capital have permanently tightened.

BOTTOM LINE

The “India Premium” now requires a “Governance Discount.” Companies that offer transparency and audited profitability will capture 80% of the capital in 2025. The rest face a 40% valuation haircut or extinction.

The era of trusting the founder’s “vision” is over; trust the auditor’s repor