THE SITUATION

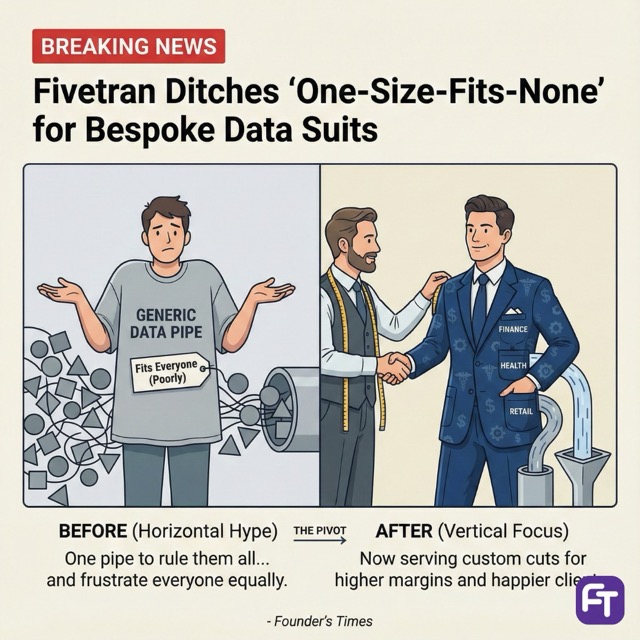

Fivetran is shifting its core strategy from horizontal data movement to verticalized “Business Schemas” for healthcare, finance, and retail. Following the October 2025 merger announcement with dbt Labs, the combined entity is deprecating the “dumb pipe” model in favor of pre-built, industry-specific data models that combine ingestion (Fivetran) with transformation (dbt).

The timing is defensive. With open-source competitors like Airbyte commoditizing the connector layer and “Modern Data Stack” fatigue driving vendor consolidation, Fivetran can no longer sustain premium pricing solely on data movement. The pivot targets the application layer: selling compliance (HIPAA/SOC2) and semantic meaning rather than just raw throughput.

WHY IT MATTERS

- For enterprise buyers: Engineering overhead drops 40% as “schema mapping” replaces custom ETL work, but vendor lock-in deepens—migrating away from Fivetran now means rewriting business logic, not just switching pipes.

- For vertical SaaS founders: Your “proprietary” integrations are being obsoleted. Fivetran’s standardized models (e.g., “Universal EMR Schema”) lower the barrier to entry for generalist competitors to attack your niche.

- For data infrastructure investors: The horizontal “connector tax” is dead. Value has shifted to the semantic layer—invest in platforms that understand what the data is, not just where it’s going.

BY THE NUMBERS

- Combined Entity Revenue: ~$600M ARR projected for 2025 (Fivetran + dbt Labs).

- Revenue Growth: Fivetran standalone ARR hit ~$325M in 2024, up 33% YoY.

- Valuation context: Merger combines Fivetran ($5.6B last private val) and dbt Labs ($4.2B last private val).

- Connector Volume: 700+ supported sources, now bundled into “industry packs.”

- Pricing Impact: Legacy “Monthly Active Rows” (MAR) model creates unpredictable cost spikes; vertical pricing likely moves to “per entity” or “per application” value.

COMPETITOR LANDSCAPE

The Commodity Threat: Airbyte Positioned as the “open-source standard,” Airbyte competes on volume and cost. With a self-hosted option and no “row tax,” it puts a ceiling on what Fivetran can charge for generic connectors (e.g., Salesforce, HubSpot).

The Vertical Specialists: Redox / MX Niche players like Redox (Healthcare) and MX (Finance) own the deep semantic layer. Fivetran’s pivot attacks them directly by offering “good enough” standardized models for a fraction of the cost, bundled with the general enterprise data warehouse.

The Platform Giants: Microsoft & Databricks Microsoft Fabric and Databricks “Unity Catalog” are aggressively bundling integration for free. Fivetran’s vertical move is an attempt to stay relevant as a neutral “Switzerland” layer that adds value beyond what the cloud providers give away.

INDUSTRY ANALYSIS

The pendulum has swung from “best of breed” (2020-2023) to “integrated efficiency” (2024-2025). CIOs are cutting distinct vendor counts. The prevailing sentiment in late 2025 is that data movement is a utility, like electricity—you don’t pay a premium for the wire, you pay for the appliance.

Capital flows reflect this. Funding for “connector” startups has evaporated. Growth equity is flowing into “Agentic AI” and “Vertical AI” applications where data integration is an invisible, embedded feature, not a standalone product. Fivetran’s shift acknowledges that in an AI-first world, the value is in the clean, structured context fed to the model, not the pipe itself.

FOR FOUNDERS

- If you are building vertical SaaS: Stop building your own integrations. The “Universal API” layer is being commoditized by Fivetran/Airbyte.

- Action: White-label a commoditized provider or use Fivetran’s embedded models. Focus engineering spend on workflow, not ingestion.

- If you are an infrastructure startup: The exit window for “point solutions” (e.g., observability only, lineage only) is closed.

- Action: Align with a major platform (Databricks, Snowflake, or the new Fivetran/dbt stack) within 6 months. Standalone tools will be de-provisioned in 2026 budget cycles.

FOR INVESTORS

- For portfolios with “Modern Data Stack” exposure: The consolidation wave (Fivetran/dbt) signals the end of the fragmentation era.

- Action: Mark down standalone ETL/ELT assets that lack a semantic layer. Push portfolio companies to bundle or merge.

- For new thesis deployment: “Vertical Data Platforms” are the new alpha.

- Signal to watch: Look for companies replacing the Fivetran+Snowflake+Tableau stack with a single, vertical-specific application (e.g., “The Data Platform for Logistics”). These integrated vertical stacks capture the margin Fivetran is trying to retain.

THE COUNTERARGUMENT

The counterargument: Verticalization limits Fivetran’s Total Addressable Market (TAM) and creates friction with partners. By defining “how data should look” (schemas), Fivetran risks becoming a rigid dependency rather than a flexible utility. If large enterprises prefer their own custom data models—which is historically true—Fivetran’s “standard models” will be ignored, leaving them with an expensive, commoditized pipe business. Furthermore, AI agents may soon handle schema mapping dynamically, rendering pre-built static models obsolete.

This would be correct if: (1) LLMs solve “dirty data” integration at scale by mid-2026, or (2) Enterprise IT teams refuse to adopt third-party standard schemas due to legacy debt.

BOTTOM LINE

Fivetran’s pivot marks the official death of the “dumb pipe” business model. Horizontal integration is now a race to zero; the only margin left is in meaning (semantics and compliance). For buyers, this means better bundled value; for competitors, it means the battleground has shifted from “number of connectors” to “quality of models.”