THE SITUATION

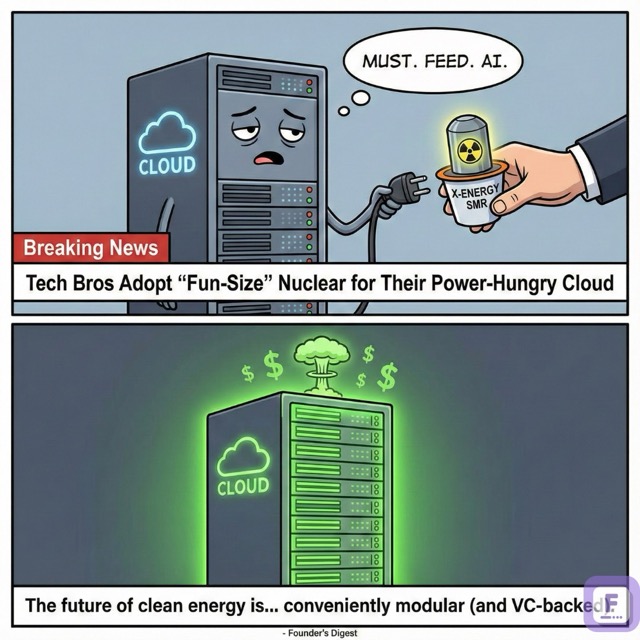

X-energy raised $700M in Series D funding on November 24, 2025, led by Jane Street and including ARK Invest. This follows a $500M Series C-1 anchored by Amazon’s Climate Pledge Fund.

The capital injection validates the “nuclear-for-compute” thesis. X-energy currently holds orders for 144 reactors representing 11GW of capacity, with Amazon alone targeting 5GW of deployment by 2039. The deal structure shifts SMRs (Small Modular Reactors) from experimental science to critical infrastructure.

The immediate impact: hyperscalers are no longer just buying power; they are financing the grid. The participation of Jane Street—a trading firm dependent on speed and uptime—signals that power reliability is now priced as a trading advantage.

WHY IT MATTERS

- For Hyperscalers: The ceiling on AI compute capacity lifts within 48 months. Amazon’s direct investment creates a blueprint for Google and Microsoft to verticalize power generation rather than relying on utility PPAs.

- For Data Center Developers: Location strategy shifts immediately from “fiber proximity” to “thermal off-take.” Sites without access to 24/7 baseload power (nuclear/geothermal) devalue by 20-30% as AI workloads demand constant uptime solar/wind cannot provide.

- For Utility Competitors: The regulated utility monopoly on generation fractures. Tech giants deploying behind-the-meter nuclear assets bypass grid congestion queues, leaving traditional utilities with slower-moving residential demand.

BY THE NUMBERS

- Series D Funding: $700M led by Jane Street (Source: SiliconANGLE, Nov 2025)

- Total Recent Liquidity: ~$1.2B including Amazon’s Series C-1 anchor (Source: X-energy Press Release)

- Pipeline Capacity: 11GW across 144 reactors (Source: X-energy Investor Data)

- Amazon Target: 5GW deployment by 2039 (Source: Amazon/X-energy Joint Statement)

- Unit Output: 80MW per Xe-100 module; 320MW per standard four-pack plant (Source: X-energy Technical Specs)

- Projected AI Energy Demand: Doubling to 945 TWh by 2030 (Source: IEA Energy & AI Report)

COMPETITOR LANDSCAPE

NuScale Power ($198M raised, public) serves as the cautionary tale. Despite being the only SMR with NRC design approval, its flagship Utah project collapsed in 2023 due to rising costs. NuScale targets utilities, a slower-moving customer base than X-energy’s tech-focused pipeline.

Kairos Power positions itself as the Google-backed alternative. Google signed a deal in Oct 2024 to deploy 500MW of Kairos’s molten-salt reactors by 2030. Kairos remains earlier in the regulatory process than X-energy but benefits from similar “big tech” balance sheet support.

Oklo (Public via SPAC) targets the micro-reactor market (1.5MW – 50MW) for smaller, off-grid deployments. While backed by Sam Altman, Oklo faces volatility in public markets and recently received an NRC application denial, forcing a regulatory reset. X-energy’s 80MW modules sit in the “Goldilocks” zone—large enough for hyperscale campuses, small enough for factory production.

INDUSTRY ANALYSIS

The structure of energy markets is inverting. Tech companies, flush with cash ($2T+ combined market cap), are bypassing debt-laden utilities to fund generation directly.

Current State: Data center expansion is grid-constrained in Northern Virginia, Ireland, and Singapore. Delays for grid interconnection exceed 5 years in key US markets.

The Shift: “Behind-the-meter” generation is the new standard. By co-locating SMRs with data centers, operators avoid transmission fees and grid queues. Amazon’s 5GW target with X-energy effectively creates an independent utility within AWS.

Public sentiment has flipped. Once a third rail, nuclear is now championed by climate pragmatists and AI accelerators alike. Jane Street’s lead investment confirms that “smart money” views energy availability as the primary bottleneck to algorithmic alpha.

FOR FOUNDERS

- If you’re building AI infrastructure: Power availability is your primary risk, not chip supply. Audit your colo providers for 2027 power capacity now.

- Action: Sign compute contracts only with providers demonstrating “behind-the-meter” power roadmaps or firm utility interconnects.

- If you’re in deep tech/hardware: Align your timeline with the SMR deployment curve (2028-2030).

- Action: Partner with SMR developers like X-energy or Kairos today for pilot programs; their order books are closing for the next decade.

- If you’re building energy software: The grid is fragmenting into micro-grids.

- Action: Pivot product roadmaps to manage “islanded” power loads for private data center grids, rather than optimizing for public grid interconnects.

FOR INVESTORS

- For Infrastructure Funds: The “reactor war” has high technical risk; the “fuel war” does not.

- Thesis Impact: X-energy’s TRISO fuel is proprietary and required for their reactors.

- Action: Invest in the nuclear fuel supply chain (HALEU enrichment, transportation, waste storage) which serves the entire SMR sector regardless of which reactor design wins.

- For Commercial Real Estate Investors: Land value is now a function of power permits.

- Action: Re-rate industrial land portfolios based on nuclear regulatory viability (exclusion zones, water access) rather than logistics proximity. A site approved for an SMR is worth 10x a standard warehouse site.

- For Public Market Investors: Watch the divergence between “nuclear-enabled” utilities and “legacy” utilities.

- Action: Overweight unregulated power producers (like Vistra, Constellation) who can sell directly to data centers; underweight regulated utilities trapped in rate-base discussions.

THE COUNTERARGUMENT

The counterargument: SMRs are a “PowerPoint asset class” with a 100% failure rate on cost containment.

No commercial SMR has been delivered on time or on budget in the West. NuScale’s failure to deliver its UAMPS project at the promised $58/MWh (costs ballooned to $89/MWh) suggests X-energy’s economics may also collapse upon contact with physical construction.

Furthermore, the fuel supply chain is broken. TRISO fuel requires High-Assay Low-Enriched Uranium (HALEU), which is currently produced at commercial scale primarily in Russia. Without a domestic HALEU supply chain—which X-energy is trying to build simultaneously with the reactor—the hardware is useless.

This analysis would be correct if: (1) Amazon and Jane Street refuse to absorb cost overruns (unlikely given the AI imperative), or (2) Domestic HALEU enrichment fails to scale by 2028.

BOTTOM LINE

X-energy’s $700M raise marks the end of the “nuclear renaissance” narrative and the start of the “nuclear deployment” cycle.

The bottleneck for AI is no longer GPU supply; it is gigawatts. Companies that control their own electrons win; those relying on the public grid lose. X-energy has the capital and the customer (Amazon) to cross the chasm—expect construction to begin within 18 months.