THE SITUATION

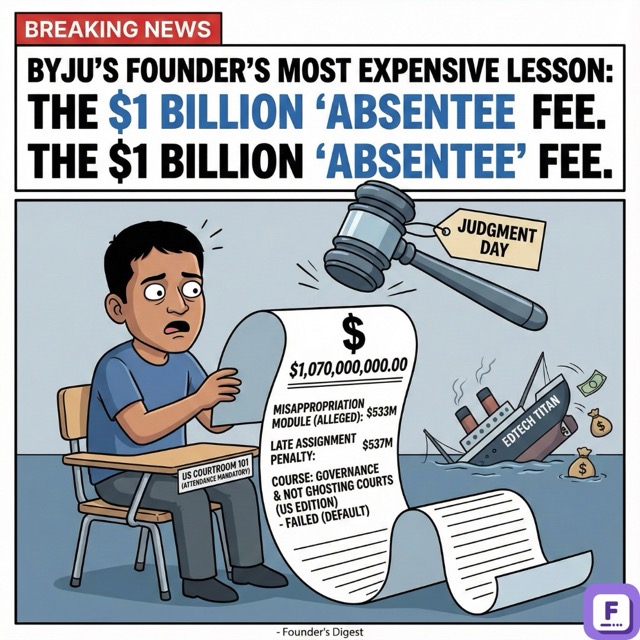

A US bankruptcy court in Delaware ordered Byju Raveendran and Riju Ravindran to pay $1.07B on November 20, 2024. Judge John Dorsey entered a default judgment after the founders refused to locate $533M in missing funds.

The court found the founders in contempt for obstructing the investigation into Byju’s Alpha, the US-based shell company that held the loan proceeds. Filings reveal the $533M was not used for legitimate business operations but was “round-tripped” through a UK logistics firm (OCI) to a Singaporean entity personally owned by Raveendran.

This ruling converts corporate debt into personal liability. The default judgment gives lenders (led by GLAS Trust) the legal authority to seize personal assets globally, bypassing the stalled insolvency proceedings in India.

WHY IT MATTERS

- For cross-border lenders: Enforcement protocols aggressively tighten. Lenders will now demand direct collateral control and US-based covenants for any debt facility over $50M, rejecting “shadow collateral” structures common in 2021.

- For late-stage Indian founders: The “India premium” evaporates. Global investors will price in a 20-30% “governance discount” on valuations until forensic audits prove clean capital flows.

- For Board members: Liability shields are piercing. The ruling implies directors can be held personally liable for “willful obstruction” in foreign jurisdictions, forcing mass resignations from boards of distressed unicorns.

BY THE NUMBERS

- Judgment amount: $1.07B ($533M principal + interest and penalties) (Source: Delaware Court Filings, Nov 2024)

- Peak valuation: $22B in March 2022 (Source: TechCrunch, 2022)

- Current valuation: Effectively zero; admitted by Raveendran in Oct 2024 (Source: Press statement via Economic Times)

- Original Loan: $1.2B Term Loan B raised in Nov 2021 (Source: Bloomberg)

- PhysicsWallah valuation: $2.8B following $210M raise in Sep 2024 (Source: TechCrunch, Sep 2024)

- Missing funds: $533M transferred to Camshaft Capital and OCI Ltd (Source: Court Filings, 2024).

COMPETITOR LANDSCAPE

PhysicsWallah (PW) has replaced Byju’s as the market leader. PW raised $210M at a $2.8B valuation in Q3 2024, driven by a profitable hybrid model (offline centers + low-cost digital). Their CAC is <20% of Byju’s peak levels due to organic community growth.

Unacademy is consolidating for survival. The company cut losses by 62% in FY24 but saw revenue flatten at ~$118M. Strategy shifted from “growth at all costs” to operational efficiency, with CEO Gaurav Munjal ruling out appraisals to preserve runway.

The market has bifurcated. High-burn, marketing-led models (legacy Byju’s) are dead. Low-cost, outcome-led hybrid models (PW, offline incumbents) are attracting the remaining capital.

INDUSTRY ANALYSIS

The Indian edtech sector is undergoing a violent correction. Funding dropped 88% from 2021 peaks, with only $278M raised in the first nine months of 2024—most of which went to PhysicsWallah.

Governance is the new growth metric. In 2021, investors funded “gross merchandise value” (GMV). In 2025, LPs are forcing funds to audit “gross governance failures.” Public sentiment has shifted from admiration to suspicion; LinkedIn posts from edtech employees focus on severance delays and toxic culture rather than product innovation.

Capital flows reflect this fear. Lenders are avoiding Indian debt markets entirely unless backed by tangible domestic assets. The “venture debt” market for Indian SaaS and edtech has effectively frozen for ticket sizes above $10M.

FOR FOUNDERS

- If you hold cross-border debt: Audit your covenant compliance immediately. Lenders are using Byju’s as a precedent to trigger technical defaults on minor reporting delays. Action: renegotiate reporting timelines before Q1 2025.

- If you are raising Series B+: Prepare a “Governance Pack” alongside your pitch deck. Investors now require third-party verification of related-party transactions. If you can’t show clean hands on money movement, the term sheet won’t arrive.

- If you operate a US subsidiary: Isolate treasury functions. Do not commingle US and India funds. The “round-tripping” allegation that sank Byju’s started with messy inter-company transfers. Keep the books distinct.

FOR INVESTORS

- For LPs with India exposure: Demand forensic audits on portfolio companies with >$500M valuations. The Byju’s case proved that top-tier auditors (Deloitte) can miss massive holes until it’s too late. Watch for: delayed filing of annual returns (more than 6 months).

- For distressed asset investors: The Aakash Institute sale is the signal. Byju’s crown jewel (Aakash) will likely be liquidated to satisfy creditors. If Aakash sells below $700M (acquired for $1B), it reprices the entire offline education sector.

- For venture debt funds: Stop lending against “brand value.” Collateralize IP and cash flows in jurisdictions with enforceable legal systems (Singapore/UK), not just Delaware LLCs that can be hollowed out.

THE COUNTERARGUMENT

The counterargument: The $1.07B judgment is a paper tiger that cannot be enforced.

Raveendran resides in Dubai and the assets are largely in India. US courts have no direct jurisdiction over Indian property, and Indian insolvency courts (NCLT) impose a moratorium on asset transfers during bankruptcy. The “corporate veil” piercing in Delaware may not hold up in Indian courts, which historically favor rehabilitating the Indian entity over satisfying foreign debt holders.

This would be true if: (1) Raveendran has no assets outside India, or (2) The UAE refuses to enforce the US judgment. However, the “fraud” classification in the US ruling makes extradition or asset seizure in friendly jurisdictions (like Dubai) significantly more likely than a standard commercial dispute.

BOTTOM LINE

The “growth at all costs” era ended in 2022; the “governance optional” era ended today. Byju’s collapse is not an isolated failure but a systemic reset for Indian startups accessing global capital. Valuation multiples for Indian unicorns will remain compressed until 2026 as the market digests the cost of this fraud. The trust deficit is the new overhead.