THE SITUATION

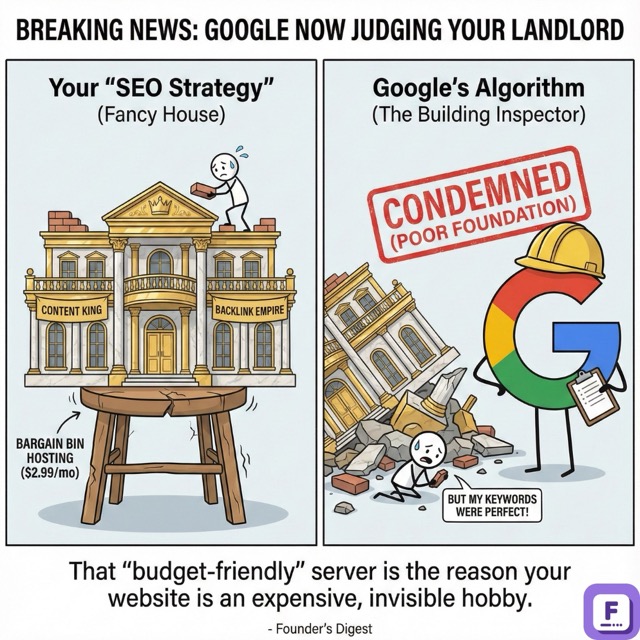

Google’s 2024 algorithm updates quietly shifted the SEO baseline from content quality to infrastructure performance. The introduction of Interaction to Next Paint (INP) as a Core Web Vital in March 2024 penalizes sites with server latency above 200ms, effectively capping the search potential of companies on shared or legacy hosting.

This moves hosting from an IT utility to a growth lever.

The mechanism is technical but the impact is commercial: slow Time to First Byte (TTFB) now directly throttles “crawl budget.” Googlebot assigns crawl resources based on server responsiveness. If infrastructure lags, new content gets indexed slower (or not at all), and existing rankings decay against competitors on edge-optimized stacks.

WHY IT MATTERS

- For e-commerce operators: Conversion drops 0.3% for every 100ms latency increase; infrastructure bottlenecks now cap revenue regardless of ad spend.

- For enterprise CMOs: Content investment yields diminishing returns (-30%) if server limitations restrict the crawl budget needed to index large site architectures.

- For digital agencies: Client retention risks rise as technical SEO failures override content wins—clients will churn if “great content” doesn’t rank due to cheap servers.

- For SaaS marketing teams: The shift to “programmatic SEO” is dead on arrival without isolated server resources that can handle 500+ concurrent bot requests.

BY THE NUMBERS

- INP Threshold: Google penalizes interactions slower than 200ms; >500ms is deemed “poor” (Source: Google Developers, 2024)

- Market Growth: Global web hosting market projected to reach $192.8B in 2025, up from $159.9B in 2024 (Source: DemandSage, Aug 2025)

- Cloud Migration: 80% of enterprises will shut down traditional data centers by 2025 to move to cloud infrastructure (Source: Gartner via Hostinger, Sep 2025)

- Shared Hosting Decline: Introductory pricing for shared plans dropped 15-30% (2020-2024) as value shifts to managed services (Source: Openprovider, Nov 2025)

- Ranking Correlation: Sites with “Good” Core Web Vitals rank 24% higher on average than those failing basic thresholds (Source: Ahrefs Data Study)

- User Expectation: 47% of users expect load times under 2 seconds; bounce rates triple at 3 seconds (Source: Hostinger, Sep 2025)

SECTOR CONTEXT

The hosting industry operated as a commodity volume game from 2010–2020. Providers like Bluehost and GoDaddy aggregated thousands of sites onto single servers (“shared hosting”), competing solely on price ($2.95/mo). Performance was secondary because Google’s algorithm primarily weighted backlinks and keywords.

This changed with the “Page Experience” update (2021) and cemented with the INP rollout (2024).

Infrastructure evolved into three distinct tiers:

- Commodity Shared (Tier 3): High density, noisy neighbors, unsuited for modern SEO.

- Managed WordPress (Tier 2): Providers like WP Engine and Kinsta introduced caching layers and CDNs to mask server latency.

- Edge/Headless (Tier 1): Vercel and Netlify pushed rendering to the edge, eliminating server lag almost entirely.

The market is currently bifurcating. Commodity providers are racing to the bottom on price, while Managed and Edge providers are capturing the entire premium segment by selling “performance as a service.”

COMPETITOR LANDSCAPE

The Commodity Incumbents (GoDaddy, Newfold Digital): Dominating the low end with ~37% market share. Their model relies on breakage (customers paying for unused domains) and upsells. They are structurally unable to offer the performance required for competitive SEO without cannibalizing their margins.

- Strategic position: Vulnerable. Churn increases as SMBs realize $5/mo hosting costs them thousands in lost traffic.

The Managed Middle (WP Engine, Kinsta, SiteGround): Positioned as the “safe choice” for SMBs and mid-market. They bundle Google Cloud Platform (GCP) infrastructure with proprietary caching.

- Metric: WP Engine hosts 30% of top managed WordPress sites.

- Advantage: Solves the INP problem via software, not just raw hardware.

The Hyperscalers & Edge (AWS, Vercel, Cloudflare): Winning the enterprise and developer market. Cloudflare alone powers ~16% of the top 1M websites. Their “Edge SEO” capabilities (serving HTML from the closest node to the user) set the new performance standard (TTFB <50ms).

- Shift: Google Cloud and AWS are becoming the default backends, but complexity forces non-tech companies to use managed intermediaries.

INDUSTRY ANALYSIS

A “silent migration” is underway. While public attention focuses on AI, technical teams are aggressively re-platforming web infrastructure.

The Shift: Companies are moving from monolithic servers to “composable” architectures. In Q3 2024, demand for “Headless CMS” solutions (which require separate, high-performance hosting) grew 22% YoY. This is driven by the realization that a site passing Core Web Vitals converts 15% better than one that doesn’t.

Public Sentiment: SEO communities are vocal about the “crawl budget” crisis. Discussion on Search Engine Roundtable and Twitter/X confirms a pattern: sites on shared hosting are seeing indexation delays of 2-3 weeks for new content. Conversely, sites on Edge infrastructure report near-instant indexation.

Capital Flows: Private equity is consolidating the managed hosting layer (e.g., Silver Lake’s stake in WP Engine). Investors are betting that “hosting” is no longer a commodity utility but a specialized software layer essential for marketing performance. Valuation multiples for managed hosting providers (6-8x revenue) now significantly outpace commodity providers (2-3x revenue).

FOR FOUNDERS

- If you run an e-commerce site on shared hosting: You are losing revenue daily. Audit your TTFB immediately using Google PageSpeed Insights.

- Action: If TTFB > 600ms, migrate to a managed provider (Shopify Plus, Kinsta, or dedicated AWS) before Q1 2025.

- Consequence: Failure to migrate risks de-ranking during the holiday season due to INP penalties.

- If you rely on content marketing (SEO): Your content budget is wasted if your crawl budget is capped.

- Action: Check your “Crawl Stats” in Google Search Console. If “Average Response Time” is >500ms, your host is the bottleneck.

- Fix: Move to a host that offers Edge Caching (Cloudflare Enterprise or similar) to offload requests from your origin server.

- If you are launching a new product: Do not default to cheap hosting to “save money.”

- Action: Budget $50-$100/mo for infrastructure from Day 1.

- Reason: It is 10x harder to recover a “slow” reputation with Google than to start fast.

FOR INVESTORS

- For portfolios with B2B SaaS assets: Audit the tech stack of your portfolio companies.

- Thesis Impact: Marketing efficiency (CAC) will degrade for companies on legacy infrastructure as organic reach shrinks.

- Action: Mandate a “Technical SEO Audit” focusing on Core Web Vitals for every portfolio company >$2M ARR.

- Signal to watch: Marketing leads complaining about “unexplained” traffic drops despite consistent content output.

- For PE/Growth equity: The “Managed Hosting” layer is the sweet spot.

- Thesis: SMBs cannot manage AWS complexity but cannot survive on GoDaddy performance.

- Action: Long providers that bridge this gap (Managed WordPress, Managed Magento).

- Risk: Avoid commodity hosting roll-ups; customer churn will accelerate as performance demands rise.

THE COUNTERARGUMENT

The counterargument: Content relevance still trumps technical performance.

Google has historically stated that excellent content can rank despite poor infrastructure. If a site provides unique, high-value information that exists nowhere else, users (and Google) will tolerate a 3-second load time. Small local businesses with low competition (e.g., “plumber in rural Ohio”) rarely need Edge infrastructure to rank #1.

Furthermore, the “Crawl Budget” issue primarily affects sites with 10,000+ pages. For a standard 50-page brochure site, Googlebot will crawl the site regardless of hosting speed.

This interpretation would be correct if: (1) you operate in a zero-competition niche, or (2) your site is extremely small (<100 pages). However, for any business in a competitive vertical, speed is the tie-breaker. When content quality is equal, the faster site wins.

BOTTOM LINE

Web hosting has graduated from a utility cost to a competitive moat.

Companies treating infrastructure as a commodity will see their SEO visibility decay 15-20% over the next 12 months as Google’s INP metric bites. The cost of premium hosting ($100/mo) is negligible compared to the cost of lost organic traffic. Upgrade the stack or accept the ceiling.