THE SITUATION

Swiggy’s 10-minute food delivery service, Bolt, now accounts for 10-12% of the platform’s total orders as of November 2024. The service operates in 700+ cities with ~80,000 restaurant partners (20% of Swiggy’s base).

The critical metric is retention, not just volume. Bolt users show monthly retention rates 4-6 percentage points higher than the platform average. While Zomato shut down its instant delivery pilot (“Zomato Instant”) in early 2023 citing poor unit economics, Swiggy aggressively scaled Bolt by leveraging existing restaurant infrastructure rather than building dark kitchens.

This changes the unit economic equation immediately. The user behavior data proves that “impulse food” (coffee, snacks) is a distinct category from “meal delivery” (dinner). Swiggy successfully unbundled the two, creating a high-frequency, lower-AOV utility layer that competes directly with Quick Commerce cafes (Zepto Cafe, Blinkit Bistro) rather than traditional restaurants.

WHY IT MATTERS

- For restaurant partners: Operations must bifurcate within 6 months. Kitchens cannot service 10-minute “Bolt” orders and 45-minute “Dinner” orders on the same line without choking throughput during peaks.

- For Zomato/Blinkit: The “wait and see” strategy failed. Zomato must relaunch a dedicated instant food tier by Q1 2025 or bleed its highest-frequency power users to Swiggy.

- For Quick Commerce players (Zepto): The moat narrows. As Swiggy Bolt delivers hot food in 10 minutes using 3P restaurants, Zepto Cafe’s capex-heavy model (using dark stores for food) faces pricing pressure from local restaurant inventory.

BY THE NUMBERS

- Bolt Share: 10-12% of total Swiggy food orders (Source: Swiggy/Kearney Report, Nov 2024)

- Retention Lift: Bolt users retain 4-6% higher than platform average (Source: Swiggy internal data via Mint, Nov 2024)

- Supply Base: 80,000 restaurants enrolled (20% of total active base) (Source: Swiggy Food CEO, Nov 2024)

- Expansion Velocity: Scaled from 500 to 700 cities between May and November 2024 (Source: Mint, Nov 2024)

- Swiggy Food Growth: Core food delivery GOV grew 17-19% YoY in Q2 FY25 (Source: Prosus/Swiggy Earnings, Nov 2024)

- Zepto Cafe Comparison: Zepto Cafe aims for $100M annualized GMV run-rate (Source: Zepto CEO, 2024)

COMPETITOR LANDSCAPE

Zomato remains the market leader in core food delivery but currently lacks a scaled sub-15 minute hot food offering. After shutting down “Zomato Instant,” it is reportedly testing “Everyday” and a new 15-minute pilot in Mumbai/Bangalore. Zomato’s subsidiary, Blinkit, is testing “Bistro” (snacks/food from dark stores) to plug this gap.

Zepto (Quick Commerce) aggressively pushes “Zepto Cafe,” serving food from its dark store network. While Zepto claims high margins, its selection is limited to reheating/assembling pre-made items. Bolt’s structural advantage is inventory depth: it taps into 80,000 active restaurant menus rather than a limited dark store SKU list. This allows Swiggy to offer “real food” (freshly made dosas, burgers) vs. Zepto’s “assembled food” (sandwiches, coffee).

INDUSTRY ANALYSIS

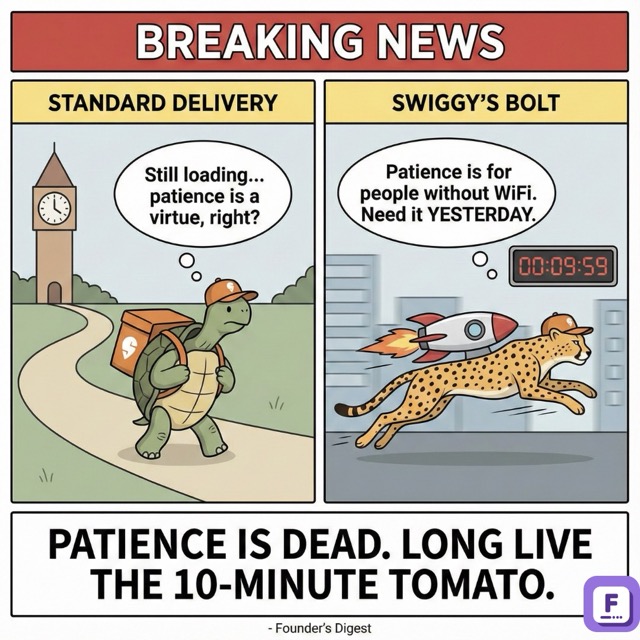

The line between Food Delivery and Quick Commerce has dissolved. Consumers no longer distinguish between “ordering groceries” and “ordering snacks”—they only distinguish by “time to door.”

Data from the Swiggy/Kearney report indicates a structural shift in consumption occasions. 10-minute delivery is not replacing the 45-minute dinner order; it is replacing the skipped order or the home pantry consumption. This creates net-new volume. However, it drags down blended Average Order Value (AOV). A Bolt order (coffee + croissant) is ~₹150-200, significantly below the core food delivery AOV of ~₹400-450.

Capital flows reflect this bifurcation. Investors are rewarding volume growth and frequency over pure basket size, betting that high-retention “snackers” eventually convert to high-margin “diners.”

FOR FOUNDERS

- If you operate a QSR/Cloud Kitchen: Audit your menu for “Bolt-readiness” immediately. Items taking >7 minutes to prep will be invisible to 10% of the market (and growing).

- Action: Create a dedicated “Express Menu” limited to 5 high-margin, low-prep items by Q1 2025.

- If you are building D2C Food Brands: The distribution channel just shifted. Being “available” on Swiggy is no longer enough; you must be “stockable” in 2km radius hubs.

- Action: Shift strategy from central kitchens to hyper-local reheating stations or partner with existing Bolt-enabled restaurants for distribution.

FOR INVESTORS

- For portfolio companies in FoodTech: Benchmark retention, not just AOV. The 4-6% retention lift in Bolt users signals that speed is the primary driver of loyalty in 2025.

- Action: Discount valuations of food brands that cannot structurally support <15 minute fulfillment; they are servicing a shrinking “slow food” TAM.

- For Swiggy/Zomato thesis: Watch the “cannibalization rate.” If Bolt orders replace Dinner orders, margins collapse (lower AOV with same logistics cost). If Bolt orders are additive (4 PM snack), share of wallet expands.

- Signal to watch: Blended AOV trends in Q4 FY25 earnings.

THE COUNTERARGUMENT

The counterargument: Bolt’s 10% share is a “sugar high” driven by discounts and novelty, not sustainable utility. Logistics costs for a 2km run are fixed (driver payout ~₹30-40). If the AOV is ₹150 (coffee), the unit economics are negative without massive density or batching. 700 cities suggests Swiggy is subsidizing logistics to show growth for its recent IPO. If inflation hits driver wages or fuel, the low-AOV model breaks first. This would be correct if Swiggy fails to achieve order batching (delivering 3 Bolt orders per run). Current density in metros suggests batching is viable, but Tier 2 viability remains unproven.

BOTTOM LINE

Swiggy Bolt has successfully segmented the food market into “Dining” (Selection) and “Fueling” (Speed). Zomato’s absence in the 10-minute hot food segment is now a strategic vulnerability, not a prudent pause. Expect AOV compression across the industry as “snacking” use cases explode, but Lifetime Value (LTV) will rise on the back of higher frequency.