THE SITUATION

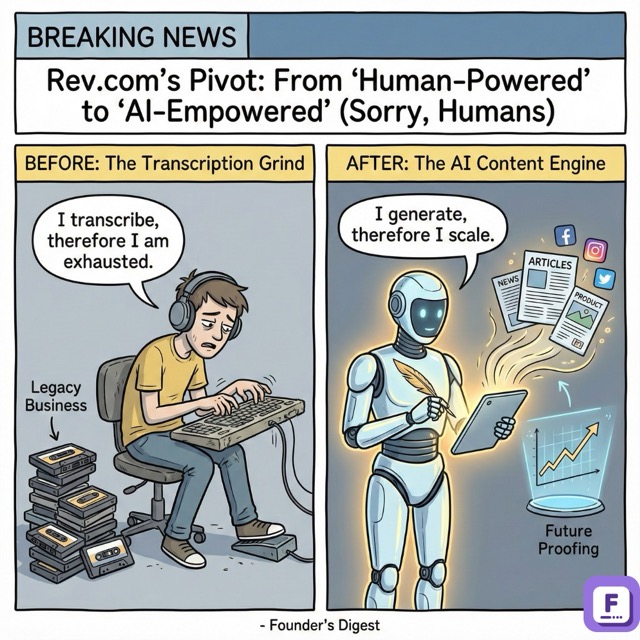

Rev.com, the dominant player in human-loop transcription, announced a strategic pivot on November 18, 2025, shifting focus from transcription services to AI content generation. The company launched “VoiceHub” and a suite of generative tools to convert audio directly into articles, social posts, and summaries.

This is a defensive cannibalization. The cost of raw AI transcription has plummeted to $0.003 per minute via APIs, destroying the unit economics of Rev’s core $1.99/minute human service. By moving up the stack to content creation, Rev attempts to escape the commoditization trap it helped create.

WHY IT MATTERS

- For content marketers: Production costs drop 90% immediately as the “transcribe → write” workflow collapses into a single step.

- For freelance transcriptionists: The gig economy for general transcription evaporates within 18 months; only legal/medical niches remain viable.

- For “Service-as-Software” founders: Rev validates the “cannibalize yourself” thesis—you must automate your own service revenue before a competitor does.

BY THE NUMBERS

- Rev’s human pricing: $1.99/minute (Source: Rev Pricing Page, Nov 2025)

- Rev’s AI pricing: $0.25/minute for transcription + generation (Source: Rev Pricing Page, Nov 2025)

- Raw API cost: Competitors like Deepgram/OpenAI offer transcription at ~$0.003–$0.005/minute (Source: Rev.ai/OpenAI API pricing)

- Otter.ai Scale: Estimated $100M ARR with 25M+ users (Source: Sacra, Oct 2025)

- Market Growth: Global AI transcription market projected to grow at 15.6% CAGR through 2034 (Source: Market.us, 2024)

- Rev Funding: ~$63M total raised from investors including Trinity Ventures (Source: PitchBook, 2025)

COMPETITOR LANDSCAPE

Otter.ai ($100M ARR) dominates the “meeting intelligence” vertical, locking in enterprise Zoom/Teams workflows. They own the “memory” layer.

Descript owns the “creative” layer, positioning transcription as a video editing interface.

Rev is squeezing into the “content” layer, competing directly with Jasper and Copy.ai but with a unique advantage: they own the source audio. While Jasper generates text from prompts, Rev generates text from truth (actual interviews/recordings). This “grounded generation” is their only real differentiator against generic LLM wrappers.

INDUSTRY ANALYSIS

The “transcription” market is dead; the “audio intelligence” market has replaced it. Public data shows a massive value shift: raw speech-to-text is a commodity (price approaching zero), while structured insight commands premiums.

VCs have pulled back from pure transcription startups (funding down ~40% YoY in the sector) while pouring capital into vertical AI agents that do work with the text. Rev’s move aligns with the broader “Service-as-Software” trend: service margins (30-40%) are being traded for software margins (70-80%), but at 1/10th the revenue per user.

FOR FOUNDERS

- If you run a tech-enabled service: Audit your revenue mix immediately. If >50% comes from human labor, you have 12 months to build the software that replaces your workers.

- If you’re building generative content tools: The “blank page” problem is solved. The new battleground is “source-grounded” content. Pivot to workflows that ingest proprietary data (audio/video) rather than just prompts.

- If you compete with Rev: Attack the “generalist” flaw. Rev is trying to be everything (legal, marketing, creative). Build a vertical-specific tool (e.g., “AI for Depositions”) that integrates deeper than Rev’s broad platform can.

FOR INVESTORS

- For portfolios with “human-in-the-loop” models: Valuation multiples compress 50% as markets price in the “AI deflation” risk. Action: Force these companies to launch a lower-cost, fully automated tier to capture the low end of the market before churn spikes.

- For new AI investments: Avoid “wrapper” companies that just transcribe. Look for “Action Engines”—tools that take a transcript and execute a workflow (e.g., update the CRM, draft the legal brief, file the claim).

- Signal to watch: If Rev’s human transcription revenue drops <20% of total revenue by Q4 2026, the pivot succeeded. If they maintain high human dependence, they failed to cross the chasm.

THE COUNTERARGUMENT

The counterargument: AI hallucinations still render “content generation” dangerous for high-stakes industries (legal, medical, broadcast).

If Rev abandons its human premium too fast, it loses its only real brand equity: trust. Generic LLMs still hallucinate facts. Rev’s 70,000 humans provide a “truth layer” that pure AI companies cannot replicate. If they automate too aggressively, they become just another commodity wrapper, losing the high-ACV enterprise contracts that require 99.9% verifiable accuracy.

BOTTOM LINE

Rev’s pivot proves that accuracy is no longer a moat—utility is. Transcription is now a feature, not a business. Founders in labor-heavy verticals have two choices: automate your own services today, or wait for a competitor to do it at 10% of your price tomorrow.